Welcome to the 300(!) new friends of the Mental Models, Concepts, and Frameworks newsletter who have joined us since last week!

Hire remote employees with confidence

“We need a front-end developer by Tuesday, but it’ll take months to find someone in the U.S.”

Ever feel like that’s you? Well, we have you covered with some exciting news. We at Faster Than Normal just found the secret weapon for ambitious companies: the talent platform, Athyna.

From finance to creative, ops to engineering, Athyna has you covered. Oh, and did I mention they hire the best global talent so you’ll save up to 70-80% from hiring locally?

No search fees. No activation fees. Just incredible talent, matched with AI precision, at lightning speed. Don’t get left behind, hire with Athyna today.

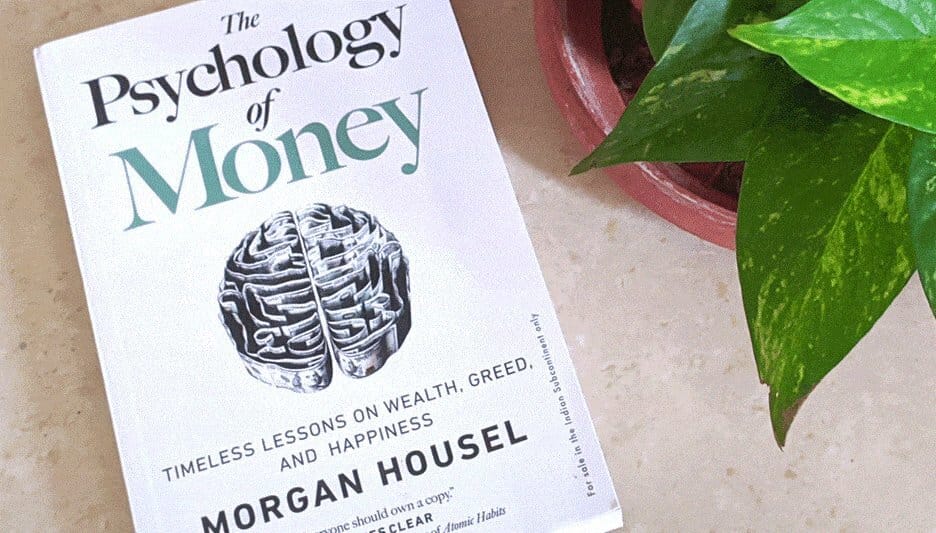

This Week: The Psychology of Money — 20 quotes psychology, building wealth, and happiness

The Psychology of Money by Morgan Housel is the best money book I've ever read.

Hidden inside this gem is a mini-degree in psychology, building wealth, and happiness.

Here are 20 quotes that will change the way you think about money:

1/

"You might think you want an expensive car, a fancy watch, and a huge house.

What you want is respect and admiration from other people, and you think having expensive stuff will bring it.

It almost never does—especially from the people you want to respect and admire you.”

2/

"Modern capitalism is a pro at two things: generating wealth and envy.

Perhaps they go hand in hand; wanting to surpass your peers can be the fuel of hard work.

But life isn’t any fun without a sense of enough.

Happiness, as it’s said, is just results minus expectations."

3/

"Control over doing what you want, when you want to, with the people you want to, is the broadest lifestyle variable that makes people happy."

4/

"No one makes good decisions all the time.

The most impressive people are packed full of horrendous ideas that are often acted upon.

These are not delusions or failures of responsibility.

They are a smart acknowledgment of how tails drive success."

5/

"You should like risk because it pays off over time.

But you should be paranoid of ruinous risk because it prevents you from taking future risks that will pay off over time."

6/

"Define the cost of success and be ready to pay it.

Because nothing worthwhile is free."

7/

"The ability to stick around for a long time, without wiping out or being forced to give up, is what makes the biggest difference.

This should be the cornerstone of your strategy, whether it’s in investing or your career or a business you own."

8/

"Not all success is due to hard work, and not all poverty is due to laziness.

Keep this in mind when judging people, including yourself."

9/

"Humility, kindness, and empathy will bring you more respect than horsepower ever will."

10/

"Respect the mess.

Smart, informed, and reasonable people can disagree in finance, because people have vastly different goals and desires.

There is no single right answer; just the answer that works for you."

11/

"Worship room for error.

A gap between what could happen in the future and what you need to happen in the future in order to do well is what gives you endurance, and endurance is what makes compounding magic over time."

12/

"The more you want something to be true, the more likely you are to believe a story that overestimates the odds of it being true."

13/

"If you want to do better as an investor, the single most powerful thing you can do is increase your time horizon.

Time is the most powerful force in investing.

It makes little things grow big and big mistakes fade away."

14/

"Become OK with a lot of things going wrong.

You can be wrong half the time and still make a fortune, because a small minority of things account for the majority of outcomes."

15/

"Manage your money in a way that helps you sleep at night.

The foundation of, “does this help me sleep at night?” is the best universal guidepost for all financial decisions."

16/

"Good investing isn’t about earning the highest returns, because the highest returns tend to be one-off hits that can’t be repeated.

It’s about earning pretty good returns that you stick with and can repeat for the longest period of time.

That’s when compounding runs wild."

17/

"The correct lesson to learn from surprises is that the world is surprising.

Not that we should use past surprises as a guide to future boundaries; that we should use past surprises as an admission that we have no idea what might happen next."

18/

"When investors have different goals and time horizons—and they do in every asset class—prices that look ridiculous to one person can make sense to another, because the factors those investors pay attention to are different."

19/

"Few things matter more with money than understanding your own time horizon and not being persuaded by the actions and behaviors of people playing different games than you are."

20/

"Optimism is a belief that the odds of a good outcome are in your favor over time, even when there will be setbacks along the way."